Fintech apps are software platforms that leverage cutting-edge technology to provide users with convenient and efficient ways to manage their finances. These apps offer a wide range of services including mobile payments, budgeting tools, investment management, and lending options all in one easily accessible platform.

Fintech apps have quickly gained popularity due to their user-friendly interfaces, real-time updates, and customizable features. With the rise of digital banking and online transactions, fintech apps have become essential tools for individuals and businesses looking to streamline their financial activities and stay on top of their money management needs.

With this blog, we will try to provide the appropriate solutions for the challenges in building a Fintech app.

Key Takeaways:

- By 2030, the FinTech market is expected to grow to a value of $851 billion.

- It is essential to thoroughly research the market and understand your target audience. By identifying their needs and pain points, you can create a product that truly adds value and meets their expectations.

- Prioritize security and compliance measures to ensure user trust and comply with regulations. Implementing robust security features and adhering to industry standards will help protect user data and maintain credibility.

- Focus on user experience and design a user-friendly interface that is intuitive and easy to navigate. Providing a seamless and engaging experience will drive user adoption and retention.

- Establish strategic partnerships and collaborations to expand your reach and offer additional services to users. By leveraging the expertise and resources of other companies, you can enhance your app’s functionality and provide more value to customers.

Let’s start by understanding the importance of fintech apps. This information will help you to avoid common mistakes when building a FinTech app.

Importance of Fintech Apps in Today’s Business Landscape

As we move ahead in 2025, fintech apps are becoming increasingly important in our everyday lives. These apps provide convenient and efficient ways to manage our finances, make payments, and track our investments. With the rise of digital currencies and blockchain technology, fintech apps are also evolving to offer more secure and transparent ways to handle transactions. In a world where technology is rapidly advancing, fintech apps are essential tools to adapt to the changing landscape of the financial industry. In 2025, these apps will continue to play a crucial role in empowering individuals to take control of their financial well-being and navigate the complexities of the digital economy.

Types of Fintech Apps:

1. Payments & Money Transfer

Payment and money transfer apps have revolutionized the way we handle our financial transactions. These apps provide a convenient and secure platform for making payments, transferring money, and managing finances on the go. To make payments and transfer money, users typically need to link their bank accounts or credit/debit cards to the app. Some apps even offer features like splitting bills, scheduling recurring payments, and receiving notifications for upcoming payments. With the rise of fintech apps, managing finances has never been easier or more efficient.

2. Personal Finance Management

Personal finance management apps are designed to help individuals better manage their money and track their spending habits. These apps are typically created using a combination of financial expertise and technological innovation. To make a successful personal finance management app, developers must first understand the needs and challenges faced by users when it comes to managing their finances. This involves conducting research and gathering data on spending patterns, saving habits, and financial goals. Once developers have a clear understanding of these needs, they can begin designing the app interface and features to provide users with a seamless and efficient way to track their finances.

By combining financial knowledge with cutting-edge technology, developers can create personal finance management fintech apps that empower individuals to take control of their financial future.

3. Lending & Borrowing

Lending and borrowing apps have become increasingly popular in recent years, revolutionizing the way people access financial services. When developing these apps, careful consideration is given to creating a user-friendly interface that allows for easy navigation and quick access to important features. By leveraging technology and innovation, lending and borrowing fintech apps offer a more convenient and accessible way for individuals to manage their finances and access much-needed funding.

4. Wealth Management & Investing

The emergence of wealth management and investing apps has transformed the financial landscape, offering users unprecedented convenience and control over their finances. These fintech solutions leverage innovative technologies to cater to the evolving needs of both consumers and financial institutions. One of the key advantages is accessibility; users can access their accounts and make investment decisions anytime, anywhere, right from their smartphones or computers. Additionally, many of these apps offer automated features such as robo-advisors, which provide personalized investment recommendations based on the user’s financial goals, risk tolerance, and time horizon. This not only saves users time but also ensures their investment strategies are tailored to their individual needs.

5. Insurance & Risk Management

We are a leading global IT services and consulting company offering innovative solutions in various industries, including insurance and risk management. Through its fintech apps, JumpGrowth provides tailored insurance and risk management solutions that help companies mitigate risk, improve operational efficiency, and enhance customer satisfaction. By offering these fintech apps, JumpGrowth enables insurance companies to stay competitive in the digital age and meet the evolving needs of their customers in a rapidly changing marketplace.

6. Blockchain-powered Solutions

We leveraged blockchain technology to provide innovative fintech solutions to its clients. By incorporating blockchain into its financial services offerings, JumpGrowth can create secure and transparent transactions, reduce processing times, and lower transaction costs for its customers.

With blockchain, JumpGrowth can provide its clients with a decentralized ledger that tracks and verifies every financial transaction, ensuring accuracy and eliminating the need for intermediaries. By harnessing the power of blockchain technology, JumpGrowth can revolutionize the way financial transactions are conducted, making it easier, faster, and more secure for both businesses and consumers.

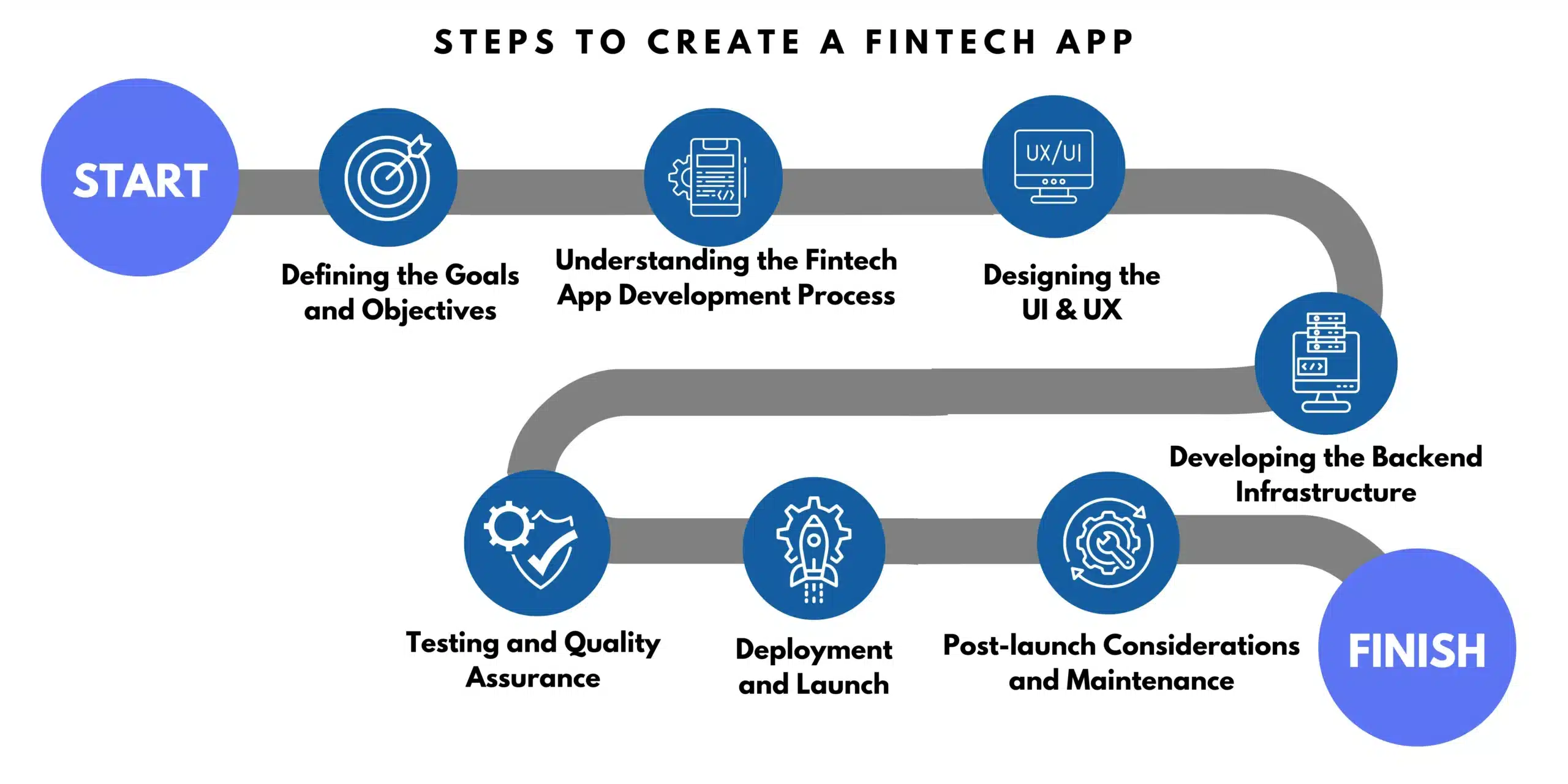

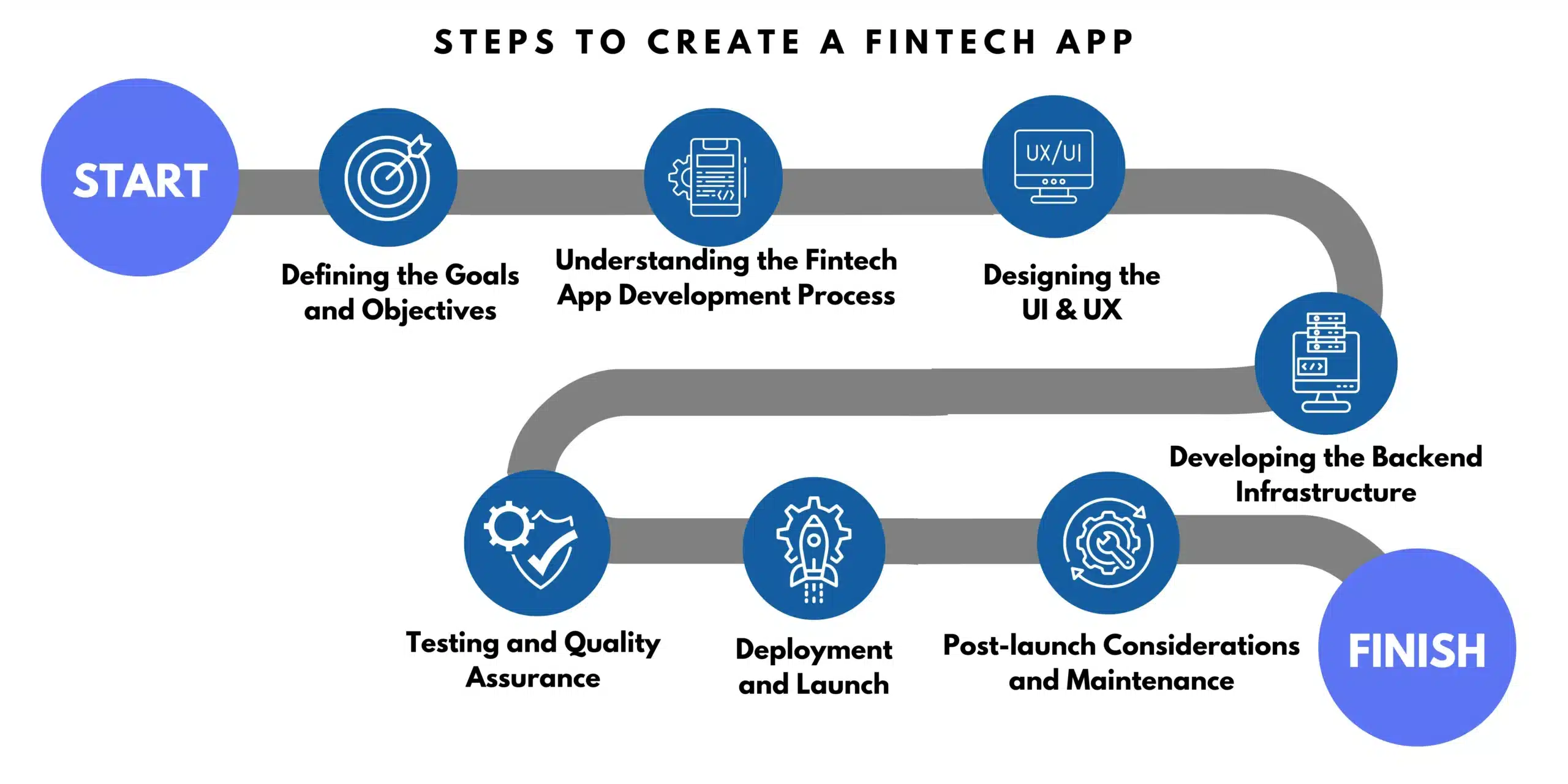

Steps to Create a Fintech App from Scratch

1. Defining the Goals and Objectives

i. Identifying the Purpose of Your Fintech App

Defining the scope of fintech apps before development is crucial in ensuring the success of the project. To begin, it is essential to conduct thorough research on the target market, competitors, and the specific needs and preferences of the users. Collaborating with stakeholders and gathering feedback throughout the planning process can also help refine the scope of the app and ensure it aligns with the project’s overall vision. By defining the scope of fintech apps before development, teams can save time, and resources, and ensure a more efficient and successful development process.

ii. Setting Clear Goals and Objectives for Your App Development Project

It is essential to establish clear goals for fintech apps before diving into the development process to ensure a successful outcome. First and foremost, it is crucial to clearly define the problem that the app is intended to solve and the target audience it is meant to serve. Understanding the specific needs and pain points of users will help to shape the features and functionalities of the app. By establishing clear goals upfront, developers can focus their efforts on creating a product that addresses a specific market need and delivers value to users.

iii. Analyzing Market Trends and Competitors

Analyzing a competitor before beginning the development process is essential for ensuring the success of a project. To do this effectively, it is important to first identify competitors within the industry and assess their strengths and weaknesses. This can be done through conducting market research, studying their products or services, analyzing their target audience, and understanding their marketing strategies. By understanding what competitors are doing well and where they may be lacking, one can better position their project for success by highlighting unique selling points and addressing any potential shortcomings.

2. Understanding the Fintech App Development Process

i. Selecting the Right Technology Stack for Your Fintech App

Selecting the right tech stack development process is crucial for the success of any project. The first step in this process is to clearly define the project requirements and objectives. Once this is done, the next step is to research and evaluate various technologies and frameworks that align with the project goals. It is important to consider factors such as scalability, robustness, ease of maintenance, and compatibility with existing systems. Additionally, it is essential to assess the skills and expertise of the development team to ensure they are proficient in the chosen technologies. Regular communication and collaboration between team members are also key in selecting the right tech stack development process. By carefully considering these factors, a well-suited tech stack can be selected that will help in achieving the project goals efficiently and effectively.

ii. Choosing the App Development Approach (Native, Hybrid, or Cross-platform)

When choosing an app development approach for hybrid cross-platform development, it is important to consider various factors to make an informed decision. Firstly, we assess the specific requirements of the project, including the target audience, features needed, and budget constraints. Next, it is essential to research and compare different fintech app development frameworks such as React Native, Xamarin, or Flutter, to determine which one aligns best with the project’s needs and goals.

iii. Creating Wireframes and Prototypes for Your Fintech App

Creating wireframes and prototypes for a fintech app is an essential step in the development process to ensure that the final product meets the needs and expectations of users. Wireframes provide a visual representation of the app’s layout and functionality, allowing designers and developers to map out the user experience and identify any potential issues or improvements. Prototypes, on the other hand, offer a more interactive experience, allowing stakeholders to test out the app’s features and functionality before it is fully developed. By creating wireframes and prototypes, fintech app developers can gather valuable feedback and make necessary revisions to ensure a seamless and user-friendly app that meets the needs of its users.

3. Designing the User Interface and User Experience

i. Importance of UI/UX Design in Fintech Apps

User interface (UI) and user experience (UX) design play a crucial role in the success of fintech apps. In the highly competitive world of financial technology, a well-designed UI and UX can make or break an app’s usability and popularity. A streamlined and visually appealing UI can attract users and keep them engaged, while a seamless UX can make navigating through complex financial processes effortless and intuitive. Furthermore, a well-designed UI and UX can build trust and credibility with users, leading to increased adoption and retention rates. In the fast-paced world of fintech, where convenience and efficiency are key, investing in UI and UX design is essential for building a successful and competitive app.

ii. Designing a User-Friendly and Intuitive Interface

When designing a user-friendly and intuitive interface, it is important to consider the users’ needs and preferences. The interface should be easy to navigate, with clear and concise labels, buttons, and menus that guide users to where they want to go. It should also have a visually appealing design that is not cluttered or overwhelming, making it easy for users to focus on the task at hand. Additionally, interactive elements such as tooltips, animations, and drag-and-drop features can enhance the user experience and make the interface more engaging. By prioritizing simplicity, functionality, and user feedback, designers can create interfaces that are intuitive and easy to use for all types of users.

iii. Incorporating Security and Privacy Considerations in the Design

We promote secure development for Fintech apps. When designing fintech applications, it is crucial to incorporate security considerations to protect sensitive financial information and maintain customer trust. Implementing strong encryption techniques, multi-factor authentication, and secure data storage practices can help prevent unauthorized access and data breaches. Additionally, regularly updating software and conducting thorough security audits can help identify and address vulnerabilities before they can be exploited by malicious actors.

4. Developing the Backend Infrastructure

i. Choosing the Appropriate Backend Technologies

When developing a fintech app, choosing the appropriate backend technology is crucial for ensuring security, efficiency, and scalability. The backend technology must be able to handle the sensitive financial data of users, securely manage transactions, and support complex algorithms for fraud detection and risk management. Overall, choosing the right backend technology is essential for creating a successful and secure fintech application that meets the needs of both users and regulatory requirements.

ii. Implementing Robust Security Measures

The rise of fintech apps has revolutionized the way we handle our finances, offering convenience and accessibility like never before. However, with the increasing digitization of financial services comes the need for robust security measures to protect sensitive information and prevent cyber-attacks. Implementing strong security protocols, such as multi-factor authentication, encryption, and regular security audits, is essential to safeguarding user data and maintaining trust in the platform. By staying proactive and investing in state-of-the-art security technologies, fintech apps can ensure that users can transact securely and confidently, contributing to the growth and success of the industry.

iii. Integrating APIs and External Services

In today’s rapidly evolving financial technology landscape, incorporating Application Programming Interfaces (APIs) and external services into fintech applications is essential for staying competitive and providing a seamless user experience. Additionally, leveraging external services such as fraud detection and credit scoring APIs can help enhance security measures and improve decision-making processes within the app. Overall, the seamless integration of APIs and external services into fintech apps can drive innovation, increase efficiency, and ultimately create a more dynamic and user-friendly financial experience.

5. Testing and Quality Assurance

i. Importance of Testing in Fintech App Development

Testing plays a critical role in the development of fintech applications as these apps deal with sensitive financial data and transactions. Ensuring that these apps are thoroughly tested for functionality, security, and compliance with industry regulations is essential to provide a seamless and secure user experience. By conducting various tests such as functional, performance, and security testing, fintech developers can detect and resolve any issues or vulnerabilities before launching the app to the market.

ii. Types of Testing to Perform (Unit, Integration, Functional, Security)

In fintech app development, various types of testing are essential to ensure the reliability, security, and functionality of the application. One of the most important types of testing is security testing, which involves identifying vulnerabilities and ensuring that sensitive financial data is protected from unauthorized access. Another key type of testing is functional testing, which verifies that the app performs as expected and meets users’ requirements. Usability testing is also crucial in fintech app development to assess the user experience and ensure that the app is intuitive and easy to navigate.

6. Deployment and Launch

i. Choosing the Right Hosting and Infrastructure

Selecting the appropriate hosting and infrastructure for an application is a crucial decision that can significantly impact its performance and scalability. The choice of hosting solution, whether it be shared hosting, dedicated servers, or cloud hosting, will influence factors such as load times, security, and availability. Additionally, the infrastructure utilized, such as databases, servers, and networks, will impact the overall stability and functionality of the application.

ii. Beta Testing and User Feedback

Beta testing and feedback are essential components in the development of fintech apps. Beta testing allows developers to gather valuable insights from real users before the app is officially released to the public. This process helps identify any bugs, glitches, or usability issues that may have gone unnoticed during the development phase, ensuring a smoother user experience. Additionally, feedback from beta testers provides developers with valuable information on how users interact with the app, what features they find useful, and what improvements can be made to enhance the app’s functionality and appeal.

7. Post-launch Considerations and Maintenance

i. Monitoring App Performance and User Feedback

To make sure a fintech app is successful, it is essential to keep an eye on its performance once it is released. Developers can keep an eye on user engagement, retention rates, and any technical problems by utilizing monitoring tools like analytics software. With the use of this data, they can enhance the app’s functionality and user experience. The identification of any potential security flaws that can jeopardize users’ financial information is another benefit of app performance monitoring.

ii. Implementing App Updates and Enhancements

Developers may fix any problems, security holes, and user feedback by updating the program frequently, which enhances the user experience overall. New features, improvements, and integrations may also be added to these updates to help the app remain competitive and adapt to the changing needs of its users. Developers can enhance adoption and retention rates by cultivating trust and loyalty among users through proactive communication and responsiveness to feedback.

Also Read: Project Management Best Practices for Successful Software Development

How JumpGrowth Help You in Fintech App Development Services?

JumpGrowth, one of the leading companies in the world, offers a range of fintech app development services and solutions to help financial institutions stay ahead in the digital age. Our expertise in developing secure, user-friendly, and innovative fintech applications enables businesses to offer seamless banking and financial services to their customers.

JumpGrowth also provides ongoing support and maintenance to ensure the apps function smoothly and efficiently. Overall, JumpGrowth, a fintech app development company empowers financial institutions to enhance customer experience, increase efficiency, and drive growth in the competitive fintech landscape.

Also Read: Banking on the Future: How to Develop a Cutting-Edge Banking App?

Conclusion:

In conclusion, a fintech app’s long-term survival and performance in a market that is becoming more and more competitive depend on the constant updates that are implemented. Fintech apps appear to have a bright future in the US as technology keeps changing how we handle our money. We hope this blog will help you with the answers to your questions regarding how to create a Fintech app from scratch.

The rising acceptance of digital payment methods and mobile banking means that fintech applications will likely have a big impact on how financial services are provided in the nation in the future. These apps’ capabilities will be further improved with the usage of blockchain, AI, and machine learning, giving users more individualized and effective financial solutions.

Want to build your own fintech app?

Need help building a successful fintech app from scratch? We can guide you.

Frequently Asked Questions:

1. How long does it take to build a Fintech app from scratch?

A) On average, it can take anywhere from a few months to a year to build a fintech app from scratch. This timeline includes tasks such as defining the project scope, designing the user interface, integrating with financial systems, testing for security and compliance, and launching the app to the public.

2. How much does it cost to develop a Fintech app?

A) The cost of Fintech app development lies between $25,000 – $200,000 or more.

3. What regulatory compliance is needed for fintech apps?

A) To operate legally and securely, fintech apps must adhere to a variety of regulatory compliance requirements. Some key regulations include data protection laws such as GDPR, which require the app to securely store and process user data, as well as financial regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements to prevent fraud and ensure customer verification.

4. What are the latest fintech app trends?

A) With the rise of artificial intelligence and machine learning technologies, fintech apps are now able to analyze user behavior and offer tailored financial advice and recommendations. Additionally, the integration of biometric authentication methods, such as fingerprint and facial recognition, has made transactions more secure and convenient for users.

AptaCloud is your trusted Microsoft-certified partner, specializing in delivering a comprehensive range of cloud and infrastructure solutions tailored to meet your business needs. From Microsoft Azure and Office 365 to advanced infrastructure management services, we empower businesses with cutting-edge technology that ensures scalability, security, and operational efficiency. Our expertise extends to implementing, managing, and optimizing Microsoft services, enabling organizations to streamline their operations, enhance productivity, and reduce costs. At AptaCloud, we are committed to providing reliable, secure, and innovative solutions that help businesses thrive in the ever-evolving digital landscape.

AptaCloud is your trusted Microsoft-certified partner, specializing in delivering a comprehensive range of cloud and infrastructure solutions tailored to meet your business needs. From Microsoft Azure and Office 365 to advanced infrastructure management services, we empower businesses with cutting-edge technology that ensures scalability, security, and operational efficiency. Our expertise extends to implementing, managing, and optimizing Microsoft services, enabling organizations to streamline their operations, enhance productivity, and reduce costs. At AptaCloud, we are committed to providing reliable, secure, and innovative solutions that help businesses thrive in the ever-evolving digital landscape. AptaCloud is your trusted Microsoft-certified partner, specializing in delivering a comprehensive range of cloud and infrastructure solutions tailored to meet your business needs. From Microsoft Azure and Office 365 to advanced infrastructure management services, we empower businesses with cutting-edge technology that ensures scalability, security, and operational efficiency. Our expertise extends to implementing, managing, and optimizing Microsoft services, enabling organizations to streamline their operations, enhance productivity, and reduce costs. At AptaCloud, we are committed to providing reliable, secure, and innovative solutions that help businesses thrive in the ever-evolving digital landscape.

AptaCloud is your trusted Microsoft-certified partner, specializing in delivering a comprehensive range of cloud and infrastructure solutions tailored to meet your business needs. From Microsoft Azure and Office 365 to advanced infrastructure management services, we empower businesses with cutting-edge technology that ensures scalability, security, and operational efficiency. Our expertise extends to implementing, managing, and optimizing Microsoft services, enabling organizations to streamline their operations, enhance productivity, and reduce costs. At AptaCloud, we are committed to providing reliable, secure, and innovative solutions that help businesses thrive in the ever-evolving digital landscape.