Modernizing Banking Technology: The Future of Digital Banking

Let’s Discuss

Banking Application Development Services

JumpGrowth offers comprehensive banking software development services. We are experts in digital transformations, app modernization, and Industry 4.0 services. Our team helps banks create innovative and seamless mobile banking applications. We leverage robust technology platforms, including AI and data analytics, to deliver secure, user-friendly, and feature-rich banking apps.

Our Unique Banking App Development Process

Design & Prototype

Develop wireframes and user interface following prototype creation and usability testing.

Build

Perform unit testing and code control after developing the bank application.

Test

Perform load, special, and automated testing on application for multiple browsers and OS.

Release

Perform infrastructure scaling after deploying the application.

Feedback

Issue reports along with the new feature request in this step.

Our Tech Stack

JumpGrowth’s banking software development service providers work with modern technologies to leverage your application.

Languages

Java, Kotlin, JavaScript, C#

Frameworks

Flutter, Xamarin, Ionic, React Native, .NET

Libraries

Socket.io, WebSocket, RxJava, Material Components

Build Tools

Jenkins, CI/CD

QA tools

GIT, Selenium, Postman, Test Flight

Application Monitoring

Zabbix, Code reviews using SonarQube

Databases and Storages

MySQL, MsSQL, MongoDB, MariaDB, PostgreSQL

Cloud

AWS, Google, Azure

On-Demand Banking Applications We Create

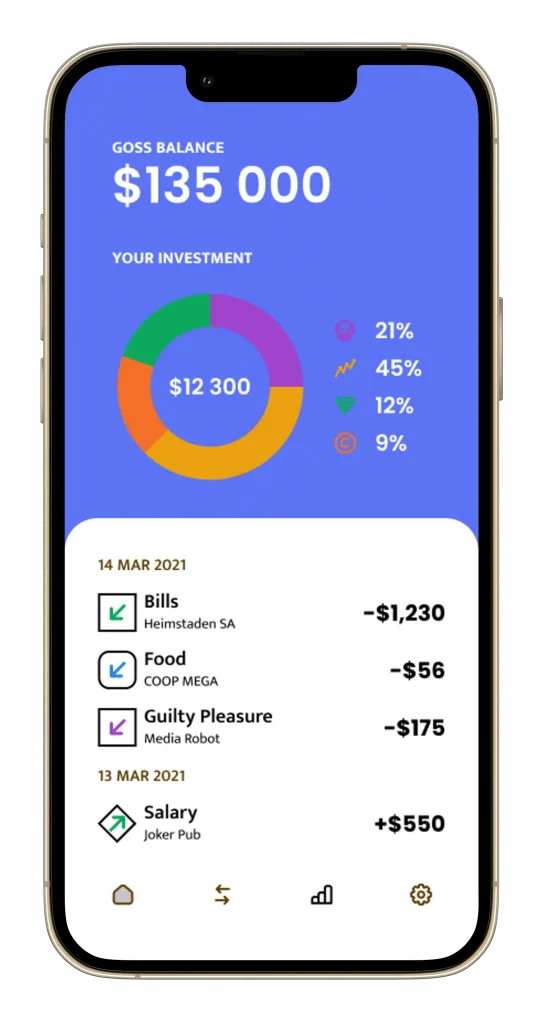

Finance Management

We offer comprehensive finance management app development services to our banking clients. On-demand apps simplify the process of budgeting, tracking expenses, and planning investments.

Bank Account Management

JumpGrowth, a banking software development company, provides a comprehensive bank account management apps that leverage technology and banking services.

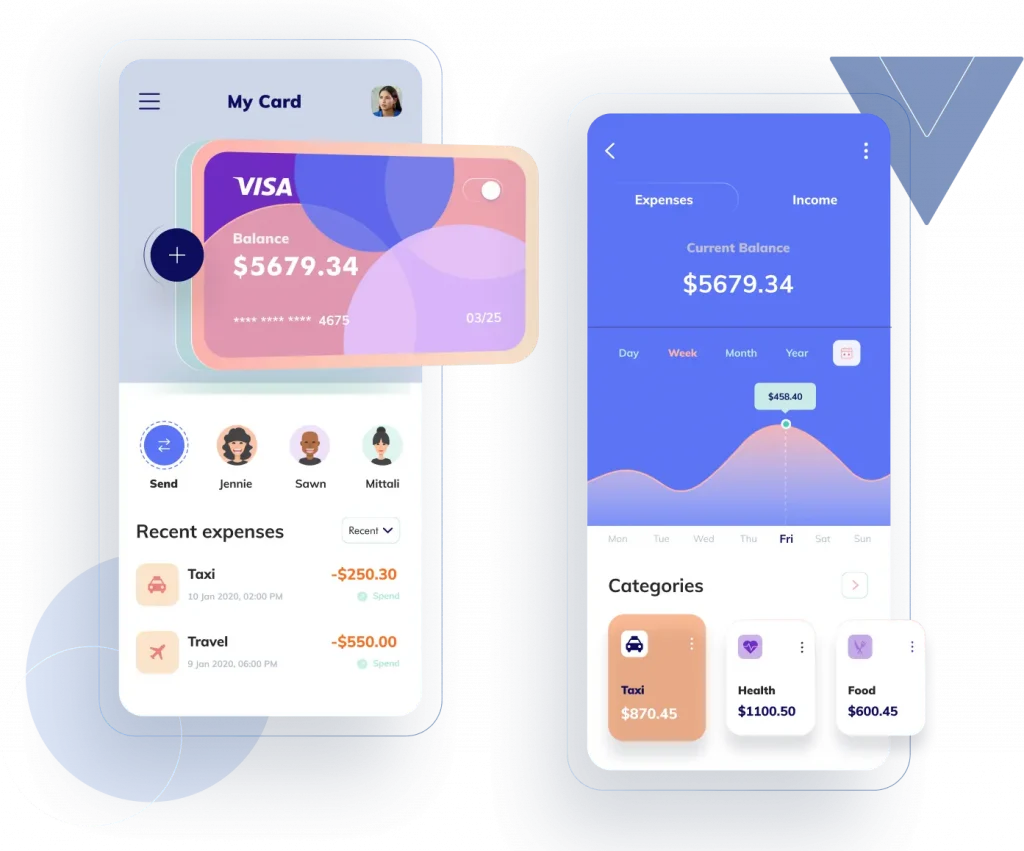

Card Management

With an on-demand card management app, clients can easily view their transaction history, activate, block, or replace lost cards, set spending limits, and receive real-time alerts for suspicious activity.

E-wallets Integration & Management

JumpGrowth offers an efficient solution for e-wallet integration and management through our innovation. Our on-demand apps provide a user-friendly interface where users can easily link their e-wallet accounts.

Corporate Banking

We understand the evolving needs of corporate banking and we develop tailor-made solutions. We offer a range of customized apps to cater to various aspects of corporate banking, including cash management, trade finance, and risk management.

Enterprise Banking App

We deliver superior mobile banking experience that encompasses various features, such as seamless transactions, personalized banking services, real-time notifications, and enhanced security.

We Cater to Financial Institutions of all Kinds

Community Banks

JumpGrowth is a leading software development company that specializes in creating apps for community banks. We aim to provide customized solutions that cater specifically to community bank clientele

Credit Unions

Our dedication to creating innovative and reliable apps has helped credit unions enhance their digital presence and stay ahead in today's competitive market.

Investment Banks

With JumpGrowth's custom app solutions, investment banks can effectively manage portfolios, monitor market trends, facilitate secure transactions, and deliver personalized services.

On-demand Features in Your Banking App

Two-factor Authentication

We build applications with two-factor authentication. It involves requiring users to provide a second form of verification, such as a unique code sent to their registered mobile number or email address.

Transfer and Payment Functionality

Our on-demand banking apps offer seamless transfer and payment functionality, allowing the user to send money to other accounts or make payments with just a few taps.

Biometric Authentication

We build apps with biometric authentication, such as fingerprint or facial recognition. With just a touch or a glance, the user can securely access their banking information, keeping their accounts safe from unauthorized access.

Bill Pay and Scheduled Transactions

Our banking apps can offer bill-pay services that allow the user to set up automatic payments for recurring bills. They can schedule future transactions, such as transferring funds on a specific date or setting reminders for upcoming payments.

Two-factor Authentication

We build applications with two-factor authentication. It involves requiring users to provide a second form of verification, such as a unique code sent to their registered mobile number or email address.

Transfer and Payment Functionality

Our on-demand banking apps offer seamless transfer and payment functionality, allowing you to send money to other accounts or make payments with just a few taps.

Bill Pay and Scheduled Transactions

Our banking apps can offer bill-pay services that allow the user to set up automatic payments for recurring bills. They can schedule future transactions, such as transferring funds on a specific date or setting reminders for upcoming payments.

Biometric Authentication

We build apps with biometric authentication, such as fingerprint or facial recognition. With just a touch or a glance, you can securely access your banking information, keeping your accounts safe from unauthorized access.

Account Management and Transaction Capabilities

This feature makes it easy for the user to track their income, expenses, and overall financial health. No more waiting for monthly statements to arrive in the mail.

Intuitive Navigation

Our on-demand banking apps strive to offer an intuitive navigation system. With clearly labeled icons and organized menu structures, we make our banking apps a breeze to navigate through various sections and perform tasks effortlessly.

Encryption and Data Protection

This feature ensures that any sensitive information the user shares through the app, such as account numbers or personal details, remains secure and protected from potential threats.

User-friendly Interface and Navigation

We understand the importance of first impressions, and that is why our banking apps have streamlined registration and login processes. With just a few simple steps, the user can create an account and get access to all the features and services offered by the app.

Why Choose JumpGrowth?

Skillful Experts

With a proven track record of delivering successful solutions to global banking institutions, JumpGrowth experts offer a comprehensive suite of innovative technologies and industry-leading practices

Innovative Team

Our innovative team of seasoned professionals understands the intricate complexities of the banking sector, ensuring the development of robust and secure applications that align with regulatory requirements.

Customer-Centric Approach

JumpGrowth emphasizes customer-centricity, aiming to provide seamless user experiences and personalized features that meet the evolving needs of banking customers.

Contact JumpGrowth For All of Your Banking Application Development Needs.

Frequently Asked Questions

What services does JumpGrowth provide?

What is the approximate cost and time commitment of building a banking application?

How can JumpGrowth help your banking institution?

Is JumpGrowth experienced in developing secure banking applications?

Talk to our industry experts today.

Let’s Discuss

Let’s Discuss

Interested? Let’s Talk..

Interested? Let’s Talk..

Let’s Discuss

Interested? Let’s Talk..

Interested? Let’s Talk..

Interested? Let’s Talk..

Hire Our Developers Now

Let’s Discuss

Let’s Discuss

Free Consultation

Contact us for a demo today.

Contact us for a demo today.

Interested? Let’s Talk..

Free Consultation

Interested? Let’s Talk..

Interested? Let’s Talk..

Interested? Let’s Talk..

Interested? Let’s Talk..

Why are you waiting? Connect with us today!

We have 500+ happy clients. You can be the next!

Talk to our industry experts today.

Interested? Let’s Talk..

Interested? Let’s Talk..

Interested? Let’s Talk..

Interested? Let’s Talk..

Talk to our industry experts today.

Hire Our Developers Now

Hire Our Engineers

Interested? Let’s Talk..

Interested? Let’s Talk..

Interested? Let’s Talk..

Interested? Let’s Talk..

Interested? Let’s Talk..

Why are you waiting? Connect with us today!

We have 500+ happy clients. You can be the next!

Talk to our industry experts today.