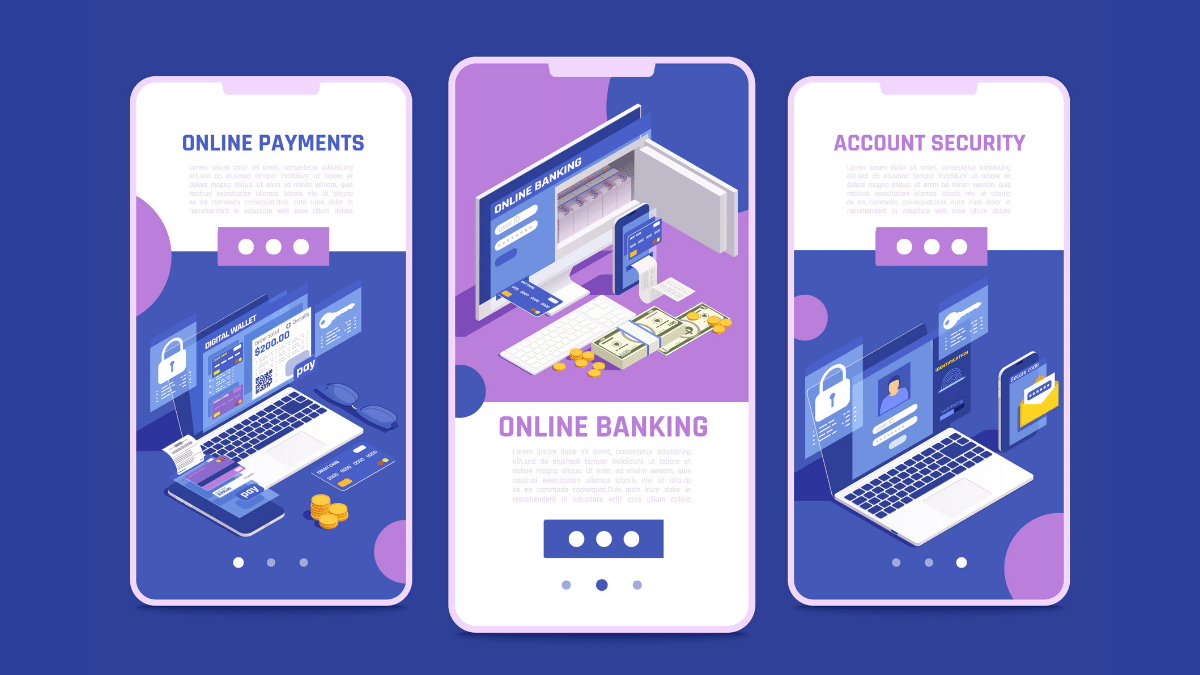

The banking industry is undergoing a transformative shift towards innovative mobile solutions in today’s fast-paced digital era. This article delves into the key considerations on how to create a mobile banking app, and the best practices required for creating it that not only enhances user experience but also prioritizes security, personalization, and performance.

We also discuss the key pointers that companies must keep in mind during the development of future-ready banking apps.

Key Takeaways:

- Java-based, Python-based, Node.js-based, and PHP-based tech stacks are the most popular tech stacks in application development.

- Spring, Ruby on Rails, Express.js, and Laravel are widely used frameworks in mobile and web development.

- Artificial intelligence, Machine learning and Cloud computing are some of the trends in app development.

- The number of Java developers worldwide is projected to rise by 28.7 million by 2024.

- The cloud computing market is expected to grow to USD 1,266.4 billion by 2028.

- By 2030, the AI (Artificial Intelligence) market is expected to be valued at $1.84 trillion, growing at a 32.9% compound annual growth rate (CAGR).

What is a Banking app?

Innovative banking app solutions are the software systems used by banks and other financial institutions to provide their customers with an online banking capability. These applications let users perform various financial transactions, such as checking account balances, paying bills, and managing investments.

Banking applications are typically accessed through a secure online portal, which requires users to enter a username and password to access their account information.

One of the key benefits of banking applications is their convenience. With these applications, customers no longer must visit a physical bank branch to access their accounts or perform financial transactions. Instead, they can manage their finances from the comfort of their own home, office, or on the go. Banking applications also provide customers with real-time information about their account balances, which can help them stay on top of their finances and avoid overdraft fees or other financial penalties.

Factors to consider when choosing a technology stack and frameworks for ranking applications.

When choosing a technology stack and frameworks for banking applications, some of the factors to consider include security, scalability, ease of use, and compatibility with other systems. It is also important to consider the long-term impact of the technology stack on the application’s maintenance and enhancement.

Popular technology stacks for banking applications

- Java-based technology stack: Java-based technology stacks are a popular choice for developing banking applications. Java is highly scalable, secure, and has a large developer community. Java frameworks such as Spring and Hibernate have been designed to make banking application development faster and more efficient.

- Python-based Technology Stack: Python is another popular choice for banking application development. It is highly adaptable, easy to learn, and has a large community of developers. Popular Python frameworks for banking applications include Django and Flask.

- Node.js-based Technology Stack: Node.js is a server-side JavaScript environment that is growing in popularity for banking applications. Node.js offers scalable and lightweight solutions for developing banking applications, Popular Node.js frameworks for banking applications include express.js and nest.js.

- PHP-based technology Stack: PHP is another popular choice for banking application development. PHP offers fast development times and a large community of developers. Popular PHP frameworks for banking applications include Laravel and Symfony.

Frameworks for Building Secure and Scalable Banking Applications

- Spring Frameworks: This is a popular choice for building secure and scalable banking applications. The framework offers features such as built-in security and support for dependency injection, making it easy to develop and maintain banking applications.

- Ruby on Rails: Ruby on Rails is another framework that is popular for building secure and scalable banking applications. Ruby on Rails offers features such as automatic code generation, built-in security, and scalable architecture, making it a popular choice for banking applications.

- Express.js: Express.js is a lightweight Node.js framework that is popular for building scalable and secure banking applications.Express.js offers features such as built-in security and support for modular development, making it easy to develop and maintain banking applications.

- Laravel Frameworks: The Laravel framework is a popular choice for building scalable banking applications, it offers features such as built-in security, making it easy to develop and maintain banking applications.

Best Practices for choosing a technology stack and frameworks for banking applications.

Creating a banking application requires careful consideration of the technology stack and frameworks. Here are some best practices to keep in mind:

1. Understand the security requirements of your banking application:

Security is a top priority for any banking application. Make sure your technology stack and frameworks support end-to-end encryption, multi-factor authentication, and other security measures that meet regulatory requirements.

2. Ensure the Scalability and flexibility of your chosen technology stack and frameworks.

As your banking application grows, you will need a technology stack and frameworks that can handle increased traffic and transaction volume. Make sure your chosen stack is scalable and flexible enough to accommodate future growth.

3. Consider the development team’s expertise.

Choose a technology stack and framework that your development team is familiar with. This will help ensure a smooth development process and reduce the risk of errors or delays.

4. Compliance with regulatory requirements

Banks are heavily regulated and must comply with a range of laws and regulations. Make sure your technology stack and frameworks support compliance with relevant regulations and work closely with legal and compliance teams to ensure your application meets all requirements.

5. Data Security and privacy concerns

Data breaches are a major concern for banks and their customers. Use technology stack and frameworks that support secure data storage and transmission and implement robust security protocols to protect sensitive data.

6. Integrating legacy systems

Integrating a new banking application with existing legacy systems can be challenging. Make sure your technology stack and frameworks support easy interaction and consider working with a vendor that specializes in legacy system integration.

How JumpGrowth is Developing Future-Ready Banking Apps?

1. Understanding User Needs and Expectations

Before we start building your banking apps, it is crucial to understand your users’ wants. By conducting user research, we know your audience and their preferences. By listening to what users have to say, we can create an app that not only meets their expectations but also wows them with features they never knew they needed.

- Identifying Key Features and Functions

A successful banking app requires the right mix of features and functions. Whether it is seamless account access, real-time transaction updates, or budget tracking tools, identifying the key elements that will make your app stand out is essential.

2. Designing a User-Friendly Interface

- Principles of User Interface Design

Designing a user-friendly interface is like creating a roadmap for your users – you want to make sure they reach their destination. By following principles of useful design, such as simplicity, consistency, and visual hierarchy, you can create an interface that is easy on the eyes & breeze to navigate.

- Creating Intuitive Navigation

Intuitive navigation guides users to where they want to go. By organizing information logically, using familiar symbols and gestures, and minimizing clutter, we can ensure that users can find what they need with minimal frustration.

3. Implementing Advanced Security Features

- Multi-Factor Authentication

Our multi-factor authentication methods add an extra layer of protection by requiring users to verify their identity through multiple methods, such as passwords, biometrics, or security questions.

- Encryption and Data Privacy

Our Encryption technology scrambles your customer’s data into a secret code. By prioritizing data privacy and using top-notch encryption methods, you can ensure that your users’ information stays confidential and secure.

4. Integrating Personalization and Artificial Intelligence

- Customized User Experiences

We integrate personalization into your app so that you can make users feel like the VIPs they truly are. Tailoring features, notifications, and recommendations based on individual preferences can turn a regular banking interaction into a personalized service.

- AI-Powered Customer Service

AI chatbots can handle customer queries, provide financial advice, and even detect fraudulent activities faster. Seamless integration of AI enhances customer service but also frees up human agents for more complex problem-solving tasks.

5. Leveraging Data Analytics for Enhanced Customer Insights

- Utilizing Big Data for Personalization

By analyzing data – from transaction histories to user behavior patterns – you can offer targeted product recommendations, anticipate needs, and create tailored solutions that make customers feel understood and valued.

- Analyzing User Behavior and Trends

Examining user behavior and trends within your app can provide invaluable insights. Understanding how customers interact with your app, what features they love, and where they drop off can help you fine-tune your offering for maximum engagement and satisfaction.

Future Trends in User-Friendly Banking App Design:

The future of banking application development is exciting and constantly evolving. Here are some emerging trends to keep an eye on:

1. Artificial Intelligence and Machine Learning:

AI and machine learning can be used to automate routine tasks like fraud detection and customer support, freeing up human resources for more complex tasks.

2. Blockchain Technology

Blockchain technology offers a secure and transparent way to store and share financial data. It has the potential to transform financial transactions and reduce fraud.

3. Cloud Computing

Cloud computing offers cost-effective and scalable hosting options for banking applications. It also offers greater flexibility and access to data from anywhere, at any time.

Also Read: Top Trends in Mobile App Development

Steps in Developing a Banking App

The development of a banking application involves multiple stages, from initial planning to final implementation. The process can be broadly categorized into four stages: Planning and requirements gathering, designing the architecture and user interface development and testing, and finally, deployment and maintenance.

1. Planning and Requirements Gathering for Modern Banking App Development:

The first stage in developing a banking application is to identify the needs and expectations of users. The development team needs to understand what the users want to achieve using the application and tailor the features to meet those needs. The next step is to analyze the market and competition. Understanding the competition and its features can help identify what the new application needs to offer to stand out from the crowd.

2. Designing the Architecture and User Interface:

We create wireframes and mockups in this stage. Wireframes and mockups are an essential part of designing the user interface of the banking application. It helps ensure the development team understands how the application will look and function.

The user interface and user experience design of the banking application are critical in ensuring an optimal user experience. The design should be intuitive, easy to use, and visually appealing.

3. Development and Testing of Banking Application:

Once the design phase is complete, the development phase starts. During this phase, the team develops the code, integrates the various features and functionalities, and tests the application.

Artificial Intelligence (AI) has become a pivotal technology in banking, with banks using AI-powered chatbots to support customer service and conduct transactions such as balance inquiries and fund transfers. AI technology also facilitates fraud detection using predictive models, and machine learning algorithms to save customers from the risks associated with online transactions.

Blockchain technology has not only provided a secure and decentralized system for financial transactions but also enabled the faster, more secure, and efficient transfer of money across borders. This technology eliminates intermediaries and makes transactions faster, more efficient, and lower costs.

Moreover, it ensures transparency in the banking industry, mitigates fraud incidents, and enhances data security.

Testing and quality assurance are crucial to ensure that the banking application works as intended. The development team should conduct extensive testing, including functional and non-functional testing, to identify and resolve issues before the application is released.

4. Preparing for the Launch of the Banking Application:

Before launching the banking application, it is essential to ensure that all necessary preparations have been made. This includes conducting thorough testing, preparing user manuals and guidelines, and setting up infrastructure to provide support to users.

Once the application has been tested, it is time to deploy the banking application and make it live. This process involves ensuring that the application is set up correctly and making it available to users.

5. Maintenance of Banking Application

Once the banking application has been launched, it is essential to ensure it is well-maintained and supported. This process includes the following steps:

- Regular updates and bug fixes are critical to ensure that the application remains secure, functional, and up-to-date with the latest technologies. We also provide quality customer support and troubleshooting services are essential to ensure that users can use the application effectively and efficiently.

- Regular monitoring of the performance and usage of the banking application is essential to identify areas that require improvement and ensure that the application continues to meet users’ needs.

- Developing an application can be a complex and challenging process. Some of the challenges that may arise during the development process include:

- Banking applications deal with sensitive financial and personal information, making it crucial to address security and privacy concerns adequately.

- Managing project timelines and budgets can be challenging, as there may be delays or expenses that can impact on the project’s overall success.

- Technical glitches and interaction issues can arise during the development process, making it essential to have a robust testing and quality assurance process in place.

- Best Practices for Successful Banking Application Development

Best Practices for Successful Banking Application Development

To ensure that the banking application development process is successful, the following best practices should be followed:

1. Collaborating with stakeholders and users

Collaborating with stakeholders and users throughout the development process can help ensure that the application meets their needs and expectations.

2. Following agile development methodologies

Agile development methodologies can help ensure that the development process is flexible, adaptable, and responsive to changing needs and requirements.

3. Ensuring scalability and flexibility of the banking application:

Ensuring that the banking application is scalable and flexible can help ensure that it can grow and adapt to changing needs over time. This can also help ensure that the application remains relevant and useful to users. It is a crucial aspect of the banking industry, and it requires careful planning, execution, and maintenance. By following best practices, addressing challenges, and collaborating with stakeholders and users, banks can ensure that their banking applications are successful and meet the needs of their customers.

What are the Important Features of Successful Banking Applications?

1. User-friendly Interface and Simple Navigation:

A successful banking application must have an intuitive interface design and streamlined navigation and search options. The interface should be designed to be user-friendly, with clear and concise language that is easy to understand. Users should be able to navigate through the application seamlessly, without any confusion.

2. Robust Security and Data Privacy Measures:

A successful banking application must ensure robust security and data privacy measures to safeguard users’ sensitive information. Two-factor authentication is an essential feature that adds an extra layer of security to the login process. The application must ensure secure data transmission and storage using advanced encryption standards to prevent data.

3. Personalized Customer Experience:

A successful banking application should provide a personalized customer experience to cater to the unique needs of each user.

Customizable personal profiles allow users to set preferences and configure the application to suit their needs. Targeted and relevant content such as promotions and offers can enhance the customer experience and build loyalty.

4. Multifactor authentication techniques for secure login:

Successful banking applications often contain multifactor authentication techniques in them. It adds an extra layer of security that requires a user to provide two or more forms of authentication to access their accounts.

5. Fraud detection and prevention measures:

To prevent fraud and frauds, such as phishing, identity theft, and account takeover. These threats can result in significant financial losses and damage to the bank’s reputation.

6. Integrating Digital Wallets in Banking Apps:

Integrating digital wallets into banking applications has several advantages, including faster and more convenient transactions. Customers can make payments directly from their digital wallets, without the need to enter their card or bank details every time.

7. Personalized fiscal management tools:

These management tools offer several benefits to both customers and banks. They improve customer engagement, provide insights to offer personalized financial products, and reduce the need for personal financial advisors. Overall, personalized fiscal management tools are an effective way to improve financial wellness and customer satisfaction.

Also Read: How To Develop An App From Scratch: Complete Guide

How are We Helping Different Banks in Application Development?

1. Community Banks

We offer innovative solutions and help community banks stay competitive in an increasingly digital world, improving customer satisfaction and loyalty. Through our expertise and dedication, we are proud to contribute to the success and growth of community banks across the US. Our team plays a key role in this process by providing expert development and design services tailored specifically to the needs and requirements of community banks.

2. Credit Unions

Building apps for Credit Unions in the US is a crucial process that requires expertise and knowledge of the financial industry. At our company, we help in building apps for Credit Unions by understanding the specific needs and requirements of each institution. We work closely with our clients to customize the app according to their branding, services, and functionalities. By partnering with us, Credit Unions can enhance their digital presence and provide a convenient and efficient way for their members to access financial services.

3. Investment Banks

Our team of skilled developers and designers collaborate closely with our clients to understand their specific requirements and objectives, ensuring that our apps are tailored to their unique needs. With our expertise in programming languages and frameworks, we can create robust and user-friendly apps that provide real-time data and analytics, facilitate secure transactions, and improve overall efficiency. By leveraging our knowledge of the financial industry and our commitment to delivering high-quality products, we help Investment Banks in the US stay competitive in a rapidly evolving market and better serve their clients.

Conclusion:

We hope you understand the steps you should take to build and successful banking application. We also cover the importance and need to transform banking applications. If you have an idea and are looking for the best company to develop a banking application, then you must contact us. We focus on Secure Banking App Development.

Want to learn more about how to develop a cutting-edge banking app?

Request a free consultation with our team today!!

Frequently asked questions:

1. What technologies can be used in developing banking apps?

Some of the technologies that are used in developing banking applications are:

- Artificial intelligence

- Blockchain

- Big Data

- Mobile Wallets

- Biometrics

Furthermore, some programming languages that can be used in the development process are Java, Python, C++, Kotlin, and Rust.

2. How can I optimize the performance of my banking app for different devices and platforms?

Here are some measures you can perform to enhance the performance of my banking app for different devices and platforms.

- Compress Data to Improve Web Application Performance

- Resolve Bottlenecks and Monitor Activities in Real Time

- Distribute Traffic with a Load Balancer

- Optimize Security Protocols

- Deliver Content Faster by Caching

- Keep Your Software Versions Updated

3. How can I optimize the performance of my banking app for different devices and platforms?

Here are some measures you can perform to enhance the performance of my banking app for different devices and platforms.

- Compress data to improve web application performance.

- Resolve bottlenecks and monitor activities in real-time.

- Distribute traffic with a load balancer.

- Optimize security protocols.

- Deliver content faster by caching.

- Keep your software versions updated.

4. How can my banking app comply with data privacy and regulatory requirements?

Here are some measures that you can take to comply with data privacy and regulatory requirements:

- Encrypt your data.

- Undertake risk assessment.

- Keep a backup of your data.

- Regularly scan the site

- Use a web application security system.

5. What are the best practices for testing and debugging a banking app?

There are various testing methods such as functional, security, UI (User Interface), and performance to ensure the safety of your banking application.

6. What are the key components of a banking application development process?

The key components of a banking application development process include planning and requirements gathering, designing the architecture and user interface, development and testing, implementation, maintenance, and support.

AptaCloud is your trusted Microsoft-certified partner, specializing in delivering a comprehensive range of cloud and infrastructure solutions tailored to meet your business needs. From Microsoft Azure and Office 365 to advanced infrastructure management services, we empower businesses with cutting-edge technology that ensures scalability, security, and operational efficiency. Our expertise extends to implementing, managing, and optimizing Microsoft services, enabling organizations to streamline their operations, enhance productivity, and reduce costs. At AptaCloud, we are committed to providing reliable, secure, and innovative solutions that help businesses thrive in the ever-evolving digital landscape.

AptaCloud is your trusted Microsoft-certified partner, specializing in delivering a comprehensive range of cloud and infrastructure solutions tailored to meet your business needs. From Microsoft Azure and Office 365 to advanced infrastructure management services, we empower businesses with cutting-edge technology that ensures scalability, security, and operational efficiency. Our expertise extends to implementing, managing, and optimizing Microsoft services, enabling organizations to streamline their operations, enhance productivity, and reduce costs. At AptaCloud, we are committed to providing reliable, secure, and innovative solutions that help businesses thrive in the ever-evolving digital landscape. AptaCloud is your trusted Microsoft-certified partner, specializing in delivering a comprehensive range of cloud and infrastructure solutions tailored to meet your business needs. From Microsoft Azure and Office 365 to advanced infrastructure management services, we empower businesses with cutting-edge technology that ensures scalability, security, and operational efficiency. Our expertise extends to implementing, managing, and optimizing Microsoft services, enabling organizations to streamline their operations, enhance productivity, and reduce costs. At AptaCloud, we are committed to providing reliable, secure, and innovative solutions that help businesses thrive in the ever-evolving digital landscape.

AptaCloud is your trusted Microsoft-certified partner, specializing in delivering a comprehensive range of cloud and infrastructure solutions tailored to meet your business needs. From Microsoft Azure and Office 365 to advanced infrastructure management services, we empower businesses with cutting-edge technology that ensures scalability, security, and operational efficiency. Our expertise extends to implementing, managing, and optimizing Microsoft services, enabling organizations to streamline their operations, enhance productivity, and reduce costs. At AptaCloud, we are committed to providing reliable, secure, and innovative solutions that help businesses thrive in the ever-evolving digital landscape.